In today’s digital era, financial technology—or Fintech—is revolutionizing the way we interact with money, banks, insurance, and investments. Whether you’re tapping your phone to pay, buying crypto, or using a robo-advisor to manage your portfolio, you are participating in the fintech revolution.

But fintech in 2025 is not just about convenience—it’s about financial inclusion, efficiency, and global access to trusted and secure financial systems. Let’s explore what fintech means today and where it’s headed.

What is Fintech?

Fintech is the fusion of finance and technology, designed to streamline, automate, and improve the delivery and use of financial services. It disrupts traditional financial systems by offering faster, cheaper, and more inclusive alternatives.

Today’s key fintech verticals include:

- Digital Payments: Mobile wallets (e.g., Apple Pay, Google Pay), QR payments, and instant transfers

- Lending & Credit: AI-driven credit scoring, P2P lending platforms (e.g., Upstart, Funding Societies)

- WealthTech: Robo-advisors, AI-managed portfolios (e.g., Betterment, Stash, Syfe)

- InsurTech: Personalized digital insurance (e.g., Lemonade, PolicyPal)

- Neobanks: Mobile-only banks (e.g., Revolut, Monzo, GrabFin)

- RegTech: Compliance automation tools for financial institutions

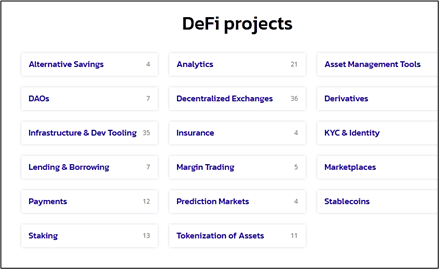

- DeFi & Crypto: Token-based finance platforms that cut out intermediaries

The Evolution of Fintech: From ATMs to DeFi

Fintech has evolved rapidly over the past few decades:

- 1980s–2000s: Online banking, ATMs, electronic trading

- 2010s: Rise of smartphones → mobile banking, P2P payments, robo-advisors

- 2020–2023: Surge in blockchain, digital assets, open banking, and fintech superapps

- 2024–2025: Emergence of DeFi, embedded finance, CBDCs, and AI-native banking

Fintech is no longer a niche—it’s the new face of mainstream finance.

Core Technologies Powering Fintech

The fintech industry now relies on powerful, emerging technologies:

1. Artificial Intelligence (AI)

- AI enables predictive analytics, fraud detection, and personalized financial planning

- Example: ChatGPT-like financial assistants integrated into banking apps

- AI helps banks cut operational costs by automating underwriting, risk assessment, and customer support

2. Blockchain & Web3

- Enables secure, immutable financial transactions

- Powers Decentralized Finance (DeFi) platforms like Aave and Compound

- Supports tokenization of real-world assets (e.g., property, artwork, bonds)

3. Big Data & Predictive Analytics

- Transforms raw financial data into actionable insights

- Helps in credit scoring, insurance risk modeling, and market trend analysis

4. APIs & Open Banking

- Open banking mandates allow third-party apps to access bank data (with user consent)

- Fintechs use APIs to deliver aggregated financial dashboards, multi-bank insights, and smart budgeting tools

5. Central Bank Digital Currencies (CBDCs)

- Pilots in China (e-CNY), Singapore, Nigeria, and soon Europe

- Promotes government-backed, programmable digital currencies

Latest Trends in Fintech

🌐 1. Embedded Finance

Financial services are now integrated into non-financial platforms—you can buy insurance while checking out online or get instant credit inside a ride-hailing app.

Examples:

- Grab integrating loans and insurance in Southeast Asia

- Shopify offering merchant loans at checkout

🏦 2. Rise of Neobanks and Fintech Superapps

Neobanks offer app-only banking experiences with no branches, low fees, and real-time analytics.

Superapps like WeChat and Gojek combine banking, payments, shopping, and investments all in one platform.

🤖 3. AI-Native Banks

Banks are being rebuilt from the ground up with AI as their core engine. Personalized investment advice, real-time alerts, and smart assistants are standard features.

💱 4. Real-World Asset (RWA) Tokenization

Tokenizing physical assets (e.g., real estate, collectibles, commodities) onto blockchain platforms increases liquidity and accessibility.

Example: BlackRock and JPMorgan are experimenting with tokenized asset funds on blockchain.

🔐 5. Fintech + Cybersecurity

Due to growing data privacy concerns, fintech firms are adopting zero-trust architecture, biometric authentication, and decentralized identity management to enhance security.

Benefits of Fintech

- Speed: Instant payments, same-day loan approvals, real-time portfolio updates

- Inclusion: Fintech reaches the unbanked in rural or underserved regions

- Customization: AI tailors investment strategies and spending habits

- Transparency: Blockchain-based solutions reduce fraud and increase accountability

- Cost Efficiency: Fintech reduces operational costs for banks and improves margins for users

Challenges That Remain

Despite progress, fintech faces ongoing challenges:

- Regulatory Uncertainty: Global variation in digital asset and lending rules

- Cyber Threats: Increased sophistication of financial fraud and phishing

- Interoperability: Ensuring seamless integration across platforms and borders

- Trust Building: Many users remain wary of fully digital financial services

What’s Next?

As we look forward:

- DeFi may challenge traditional finance with borderless, permissionless systems

- CBDCs will reshape how nations think about monetary policy and remittances

- AI + Blockchain fusion could lead to smart, self-executing financial products

- Sustainability-focused Fintech will rise, combining green finance with impact investing

Final Thoughts

The fintech revolution is not slowing down—it’s accelerating. As new technologies emerge and regulations mature, the financial world will become more inclusive, intelligent, and decentralized.

Whether you’re a student, investor, entrepreneur, or policymaker, staying updated with fintech trends is no longer optional—it’s essential.

🚀 Welcome to the future of finance. It’s digital, decentralized, and designed for everyone.