In today’s digital age, the financial world is evolving at an unprecedented pace. The convergence of financial technology (fintech) and stablecoins is creating new opportunities for inclusion, efficiency, and innovation. From decentralized finance (DeFi) and cross-border payments to programmable money and regulatory sandboxes, this transformation is reshaping the global financial system.

This article explores how fintech and stablecoins are building a more resilient digital economy—and how countries like Malaysia, Singapore, and Hong Kong are positioning themselves at the forefront.

💡 What Is Fintech?

Fintech refers to the use of digital technologies to enhance, automate, or reinvent financial services. It spans everything from mobile banking and digital wallets to blockchain, AI-based risk scoring, robo-advisors, and beyond.

🚀 The Evolution of Fintech:

- Fintech 1.0: Telegraphs and ATMs marked early automation.

- Fintech 2.0: SWIFT, credit cards, and online banking digitized financial systems.

- Fintech 3.0: Smartphones enabled peer-to-peer payments and crypto adoption.

- Fintech 4.0: Today’s innovations include Web3, artificial intelligence, DeFi, and stablecoins.

Fintech democratizes access to finance and streamlines services across sectors, especially in underserved markets and emerging economies.

💳 Digital Payments: A Global Shift

The move toward cashless economies is accelerating. Digital wallets, QR code payments, and contactless transactions are becoming the norm.

- 📱 Popular Wallets: Apple Pay, Google Pay, Alipay, Touch ‘n Go, WeChat Pay

- 🌐 Growth: Over 60% of global e-commerce payments are expected to be made via digital wallets by 2026.

This shift enhances convenience, lowers transaction fees, and supports financial inclusion—especially in rural and mobile-first regions.

🔗 Blockchain and Decentralized Finance (DeFi)

Blockchain technology provides the foundation for decentralized systems that are secure, transparent, and resistant to tampering.

It powers:

- Cryptocurrencies like Bitcoin and Ethereum

- Smart contracts that self-execute financial logic

- DeFi platforms for lending, borrowing, and trading without intermediaries

Together, blockchain and DeFi are redefining how finance is conducted—offering 24/7, permissionless access to capital.

🪙 What Are Stablecoins?

Stablecoins are digital currencies designed to maintain a stable value, usually pegged to a reserve asset like a fiat currency, commodity, or algorithmic model. They serve as a bridge between traditional and decentralized finance, offering the speed of crypto with the predictability of money.

📌 Why Stablecoins Matter:

- Reduce price volatility

- Enable global remittances and real-time payments

- Power smart contracts and DeFi ecosystems

- Act as a store of value in high-inflation economies

🧱 Types of Stablecoins:

| Type | Backed By | Examples |

|---|---|---|

| Fiat-backed | USD, MYR, etc. | USDT, USDC, FUSD |

| Crypto-backed | ETH, BTC (overcollateralized) | DAI |

| Commodity-backed | Gold or other assets | PAXG |

| Synthetic/Algorithmic | Derivative-based | USDe (Ethena) |

🌟 Major Stablecoins in 2025

1. USDT (Tether)

- The most widely used stablecoin globally

- Pegged to USD, backed by mixed reserves

- Ideal for trading, DeFi, and fast settlements

2. USDC (USD Coin)

- Issued by Circle; fully backed by U.S. dollar reserves

- Highly regulated, widely adopted across platforms

- Preferred by enterprises and institutions

3. DAI

- Decentralized stablecoin issued by MakerDAO

- Collateralized by crypto (ETH, USDC)

- Maintained via smart contracts and governance

4. FUSD (Frax USD)

- A partially algorithmic stablecoin transitioning to full collateralization

- Known for yield-bearing integrations in DeFi

5. USDe (Ethena USD)

- Synthetic stablecoin backed by hedging strategies

- Offers capital efficiency, gaining traction in modern DeFi

6. PAXG (Paxos Gold)

- Tokenized gold asset; each token backed by one ounce of gold

- Combines crypto liquidity with physical value

🔧 Real-World Applications of Stablecoins

💰 DeFi Lending and Borrowing

Platforms like Aave and Compound use stablecoins for peer-to-peer lending—offering liquidity, yield generation, and financial access.

🌍 Cross-Border Payments

Stablecoins eliminate FX fees and delays, allowing businesses and workers to transact globally in seconds.

🛒 E-Commerce and BNPL

Buy Now Pay Later services can be built using smart contracts and stablecoins, enabling instant approvals and programmable repayments.

🧾 Payroll and Gig Economy

Freelancers and gig workers can receive salaries in stablecoins, offering fast and borderless compensation.

🏠 Tokenized Real-World Assets

From real estate to commodities, assets are being tokenized and traded using stablecoins as a secure, liquid medium of exchange.

🏛️ Regulatory Highlights & National Projects

Countries are moving quickly to regulate stablecoins while fostering innovation. Here’s how Malaysia, Singapore, and Hong Kong are leading in Asia:

Malaysia – Blox: Ringgit-Based Stablecoin (Proposed)

- Blox is a Ringgit-backed stablecoin concept under review by Bank Negara Malaysia (BNM).

- It aims to power e-commerce, DeFi, and cross-border payments using a localized, compliant digital currency.

- May be tested under Malaysia’s Fintech Regulatory Sandbox.

- Seen as a key tool for Shariah-compliant digital finance and boosting financial inclusion.

Malaysia’s cautious but inclusive approach emphasizes domestic utility, compliance, and Islamic fintech potential.

Check it out at https://app.blox.my/signup?invite=BLOX-3a38e5

Singapore – Project Orchid: A Global Blueprint

- Project Orchid is a stablecoin regulatory framework launched by the Monetary Authority of Singapore (MAS).

- It includes requirements for:

- 1:1 fiat reserve backing

- Guaranteed redemption at par value

- Transparent audits and disclosures

- Encourages real-world applications like:

- Government aid distribution

- Retail payments

- Cross-border enterprise use

Singapore combines policy clarity with fintech openness, making it a launchpad for stablecoin innovation.

Hong Kong – Institutional-Grade Licensing

- The Hong Kong Monetary Authority (HKMA) is developing a licensing framework for fiat-referenced stablecoins.

- Key requirements include:

- Full reserve backing in high-quality liquid assets

- Monthly reporting and third-party audits

- Strong cybersecurity and risk management

- Part of a broader Web3 strategy to attract institutional capital and support regulated virtual asset providers (VASPs).

Hong Kong is shaping a rigorous, compliance-driven framework targeting institutional finance and enterprise adoption.

🌏 Regional Overview

| Country | Strategy Focus | Status | Use Cases |

|---|---|---|---|

| Malaysia | Local fintech & DeFi | Conceptual/Pilot | MYR stablecoin, e-commerce, DeFi |

| Singapore | Innovation & Regulation | Active Implementation | SGD stablecoins, enterprise payments |

| Hong Kong | Institutional oversight | Licensing in progress | Regulated stablecoins for Web3 finance |

🔮 What’s Next for Fintech & Stablecoins?

The future of digital finance is taking shape through several trends:

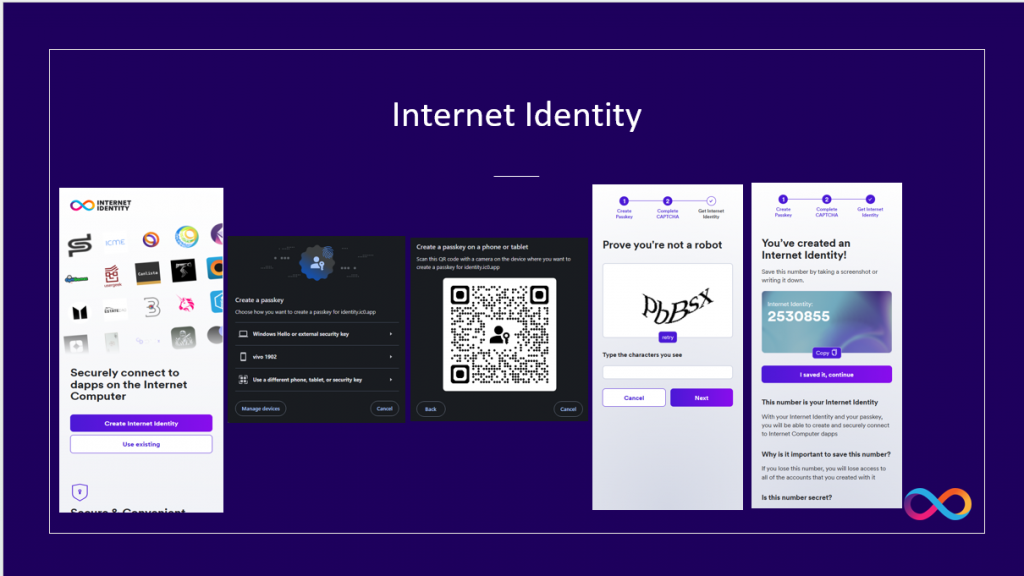

🔁 Interoperability

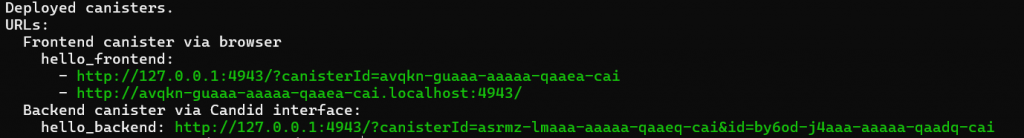

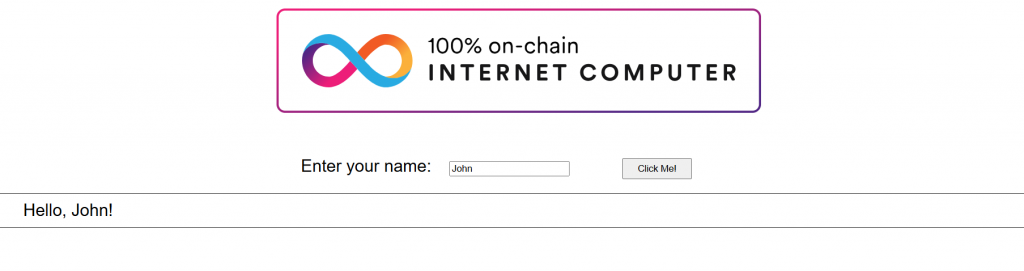

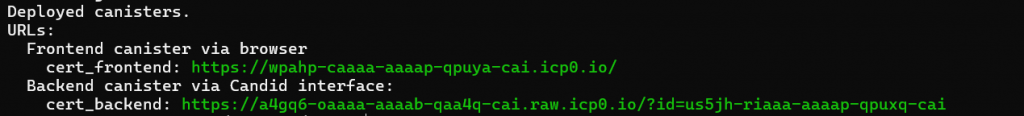

Cross-chain bridges and Layer-2 solutions are making stablecoins usable across ecosystems like Ethereum, Solana, and Internet Computer (ICP).

⚙️ Programmable Money

Smart contracts are enabling programmable payrolls, subsidies, taxes, and grants.

🏦 Institutional Stablecoins

Banks and financial firms are issuing their own stablecoins for B2B use, liquidity management, and compliance.

🌐 CBDC Coexistence

Stablecoins and Central Bank Digital Currencies (CBDCs) will likely coexist—with stablecoins leading in flexibility and programmability, while CBDCs serve core public infrastructure.

🌍 Rise of National Stablecoins

Countries are issuing sovereign stablecoins (e.g., Malaysia’s Blox) to promote currency sovereignty, data localization, and regulated DeFi.

✅ Conclusion

Fintech and stablecoins are more than just buzzwords—they are building blocks of the next financial era. As infrastructure matures and regulations evolve, we are witnessing the creation of a borderless, decentralized, and inclusive financial system.

💡 The financial future will be co-created by governments, developers, and users—with stablecoins at the center of trust, efficiency, and innovation.